Analysis | Defense Space Demand Is Real, But Startups Are Chasing the Wrong Signals

A grounded look at why defense space budgets reward resilience and sustainment, not hype-driven innovation.

Introduction: The Demand Signal Everyone Is Misreading

Defense spending is rising across the United States, Europe, and parts of the Indo-Pacific. Space is now firmly embedded in military doctrine, no longer treated as a benign enabler but as a contested warfighting domain. On the surface, this should be a golden era for defense-focused startups, particularly those operating in space technology.

Yet the market signals I see from procurement data, budget lines, and acquisition behavior tell a different story. Demand is real, but it is highly selective. Growth is flowing toward capabilities that reinforce resilience, redundancy, sustainment, and operational continuity, not toward headline-grabbing concepts or unproven technological leaps.

The strategic question startups must confront is not whether defense demand is rising, but where it is actually being converted into contracts.

Doctrine vs. Dollars: Where Strategy and Budgets Diverge

Western defense doctrines increasingly emphasize space superiority, rapid decision-making, and multi-domain integration. Documents from the U.S. Department of War, NATO, and the European Defence Agency all stress space resilience, protection of orbital assets, and assured access to space-enabled services.

But doctrines are not procurement plans.

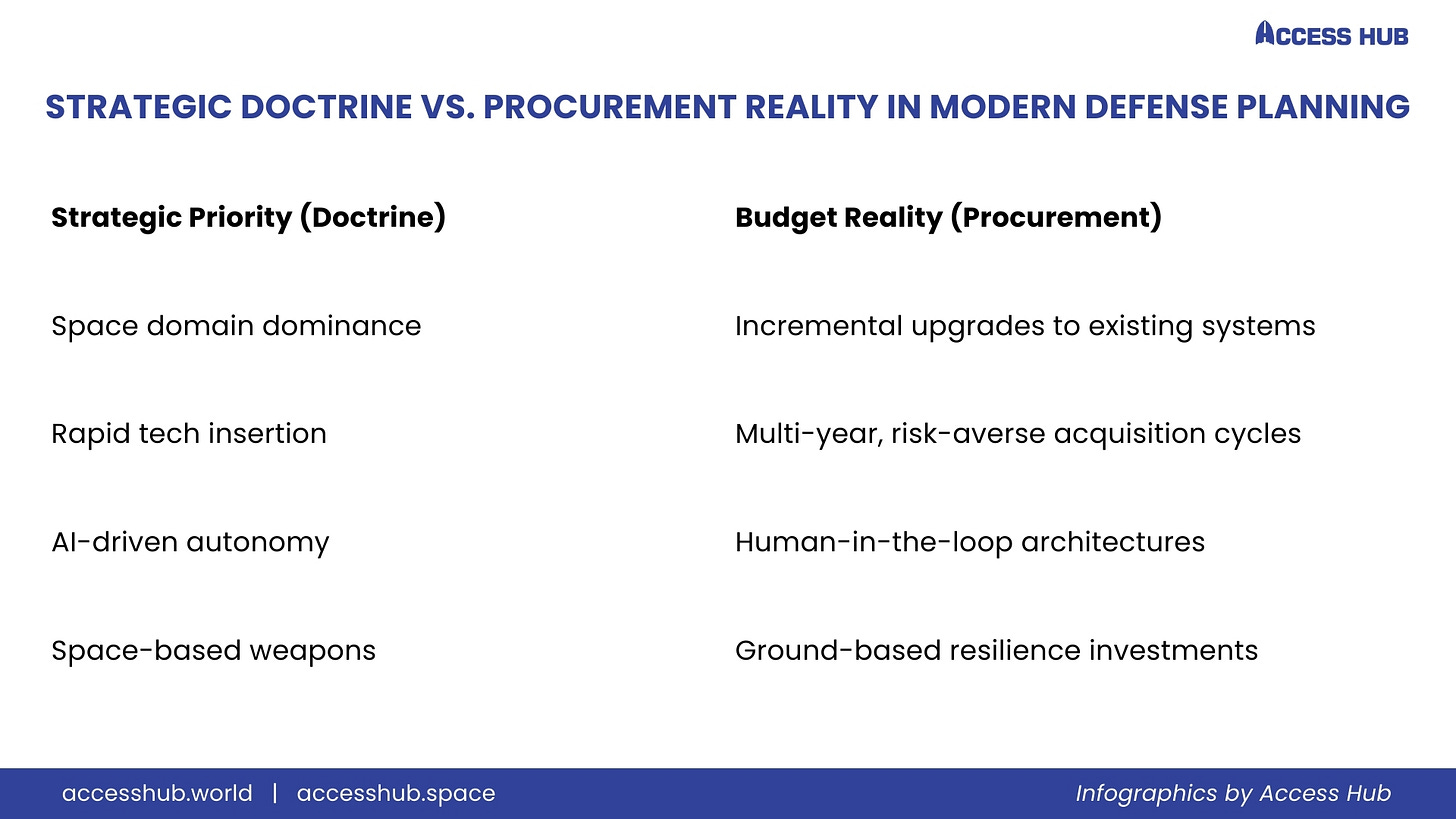

When you examine actual budget allocations inside the U.S. Space Force or the European Space Agency’s defense-adjacent programs, a clear pattern emerges:

This gap is not accidental. Defense buyers are responding to operational risk, political oversight, and sustainment costs, not just technological promise.

The Real Growth Areas in Defense Space Procurement

1. Resilient Satellite Architectures

The most consistent procurement growth is in distributed and resilient architectures. The Space Development Agency’s proliferated low Earth orbit (LEO) approach is instructive. Rather than investing solely in exquisite, high-cost satellites, buyers are prioritizing numbers, redundancy, and rapid replenishment.

This trend favors companies working on:

Satellite buses with standardized interfaces

Rapid manufacturing and integration

Launch responsiveness and reconstitution

It is no coincidence that primes like Lockheed Martin and Northrop Grumman are doubling down on modular spacecraft lines, while startups providing incremental improvements in manufacturing or integration find clearer pathways to contracts.

2. Ground Segment and Sustainment Infrastructure

Space remains useless without the ground systems that command, control, and exploit it. Procurement data increasingly shows steady investment in:

Ground stations and antenna networks

Mission planning and satellite operations software

Cyber-secure command and control systems

Companies like Viasat and SES benefit not because they are disruptive, but because they are reliable, interoperable, and already embedded in military workflows.

For startups, this is an uncomfortable truth: ground infrastructure is boring, but it gets funded.

Space Situational Awareness: Demand Without Glamour

Space Situational Awareness (SSA) is often discussed as a future growth market. In reality, it is already a procurement priority, but one dominated by trust, data continuity, and long-term contracts.

The U.S. Space Command and allied partners rely on SSA capabilities not for innovation theater, but for operational safety and escalation control. This explains why companies such as LeoLabs have secured steady government engagement by focusing on data quality, coverage, and reliability rather than speculative analytics.

SSA buyers want:

Persistent coverage

Low false-alarm rates

Interoperability with allied systems

They are not looking for flashy dashboards or unproven AI models.

The Myth of Rapid Military Adoption

One of the most damaging myths in the defense startup ecosystem is the belief that modern militaries adopt technology quickly if it is “good enough.”

They do not.

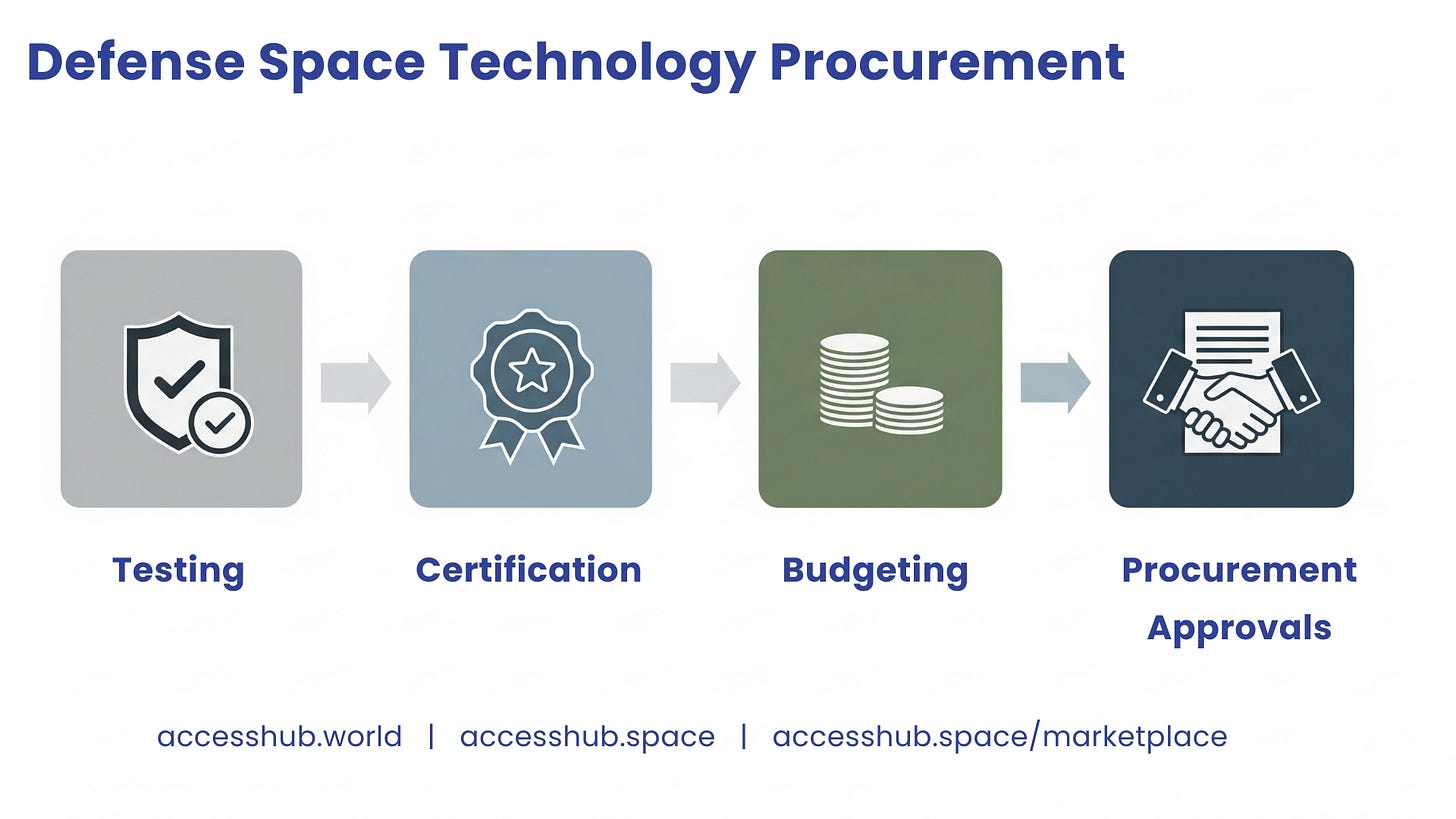

Even urgent operational needs must pass through:

Requirements definition

Testing and evaluation

Security accreditation

Budgetary approval

Contracting mechanisms

This is why programs at the Defense Innovation Unit often take years to translate prototypes into scaled procurement.

Startups that mistake pilot programs for market validation frequently underestimate the time, capital, and compliance burden required to reach meaningful revenue.

Why Novelty Loses to Sustainment

Defense buyers are rewarded for minimizing failure, not for maximizing innovation. A satellite that works reliably for 10 years is often more valuable than a revolutionary platform that fails once.

This explains procurement preferences for:

Incremental upgrades over clean-sheet designs

Dual-use technologies with proven commercial heritage

Vendors with supply-chain resilience and export compliance

In this environment, “novelty” is not a competitive advantage unless it directly reduces cost, risk, or sustainment complexity.

Europe and the Indo-Pacific: Different Rhetoric, Same Behavior

European defense rhetoric emphasizes strategic autonomy, while Indo-Pacific states stress deterrence and regional stability. Yet procurement behavior converges around similar priorities.

Countries such as Japan and Australia are investing heavily in:

Hosted payloads

Allied interoperability

Shared ground infrastructure

Meanwhile, European programs increasingly rely on industrial champions like Airbus Defence and Space to de-risk acquisitions through existing platforms.

For startups, geographic diversification does not eliminate the core challenge: buyers everywhere value continuity over experimentation.

Who Wins in This Market

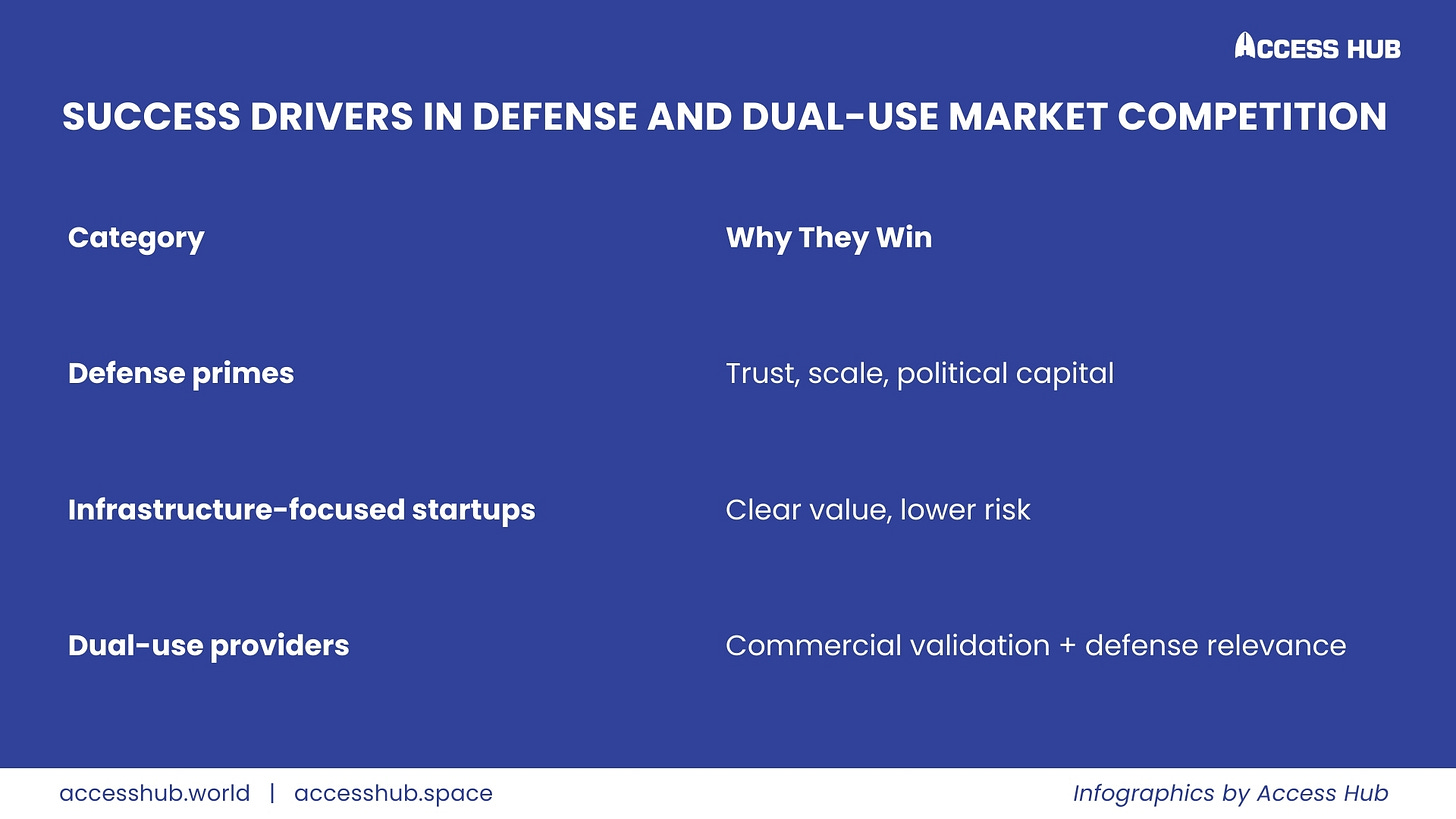

Based on current procurement trajectories, the winners fall into three categories:

Pure-play “moonshot” defense startups, by contrast, face the steepest uphill battle unless they align tightly with existing programs of record.

Strategic Advice for Defense-Focused Startups

If you are building for the defense space market, three strategic adjustments matter more than pitch-deck polish:

Design for integration, not disruption

Price sustainment, not just deployment

Assume procurement timelines measured in years, not months

The fastest-growing companies I observe are those that quietly embed themselves into supply chains, ground systems, and sustainment contracts rather than chasing transformative headlines.

Conclusion: Follow the Budget, Not the Buzz

Defense demand is real and rising. But it is not flowing toward where most startups are looking.

Procurement growth favors resilience over revolution, redundancy over elegance, and sustainment over novelty. Those who align with these realities will find opportunity. Those who mistake strategic rhetoric for acquisition intent will continue to burn capital waiting for contracts that never arrive.

The defense space market does not reward those who move fast. It rewards those who endure.

Today’s defense and space markets reward those who act on intelligence, not just collect it. That’s where Access Hub steps in.

We go beyond headlines to decode market movements, connect innovators with decision-makers, and help organizations convert strategic insight into real business traction across Space, Defense, Aerospace, Maritime, Media-Tech, and Energy Markets.

If your team is navigating these fast-moving domains, Access Hub is your partner for clarity, connection, and competitive edge. Contact us at: www.accesshub.world